Bipartisan Commission Reports LTC Costs Rising

For the first time since 2004, long-term care services, including in-home care and nursing home care, have increased in costs faster than the rate of inflation. Bipartisan Policy Center, a Washington, DC-based think tank, said in a new report that long-term care providers saw significant cost increases from 2019 to 2020 with increased demand for care and higher labor costs as there were shortages of caregivers.

The Bipartisan Policy Center was formed by Democrat Tom Daschle and Republican Bill Frist, former Senate Majority leaders; former Secretary of Health and Human Services and Gov. Tommy Thompson (R); and others.

The LTC NEWS Cost of Care Calculator shows the current 2021 national averages ranging from $19,861 a year for adult day care centers to $106,488 for nursing home care.

The report cites several challenges for those who need long-term care services that impact both families and finances. The increasing cost of care services along with the shortage of caregivers relative to increasing demand will make it difficult today and in the coming years.

Growing Demand for Long-Term Care Means Higher Costs

The Bipartisan Policy Center cites a recent report from the U.S. Department of Health and Human Services that says about half of the 65-year-olds will need long-term care services and supports at some point in their lifetime. The need for long-term care should grow as Generation X and the Late-Boomers follow the remaining baby boomers in getting older and needing a significant amount of help and assistance.

Long-term care is help with activities of daily living (ADLs), such as eating, bathing, or dressing, and instrumental activities of daily living (IADLs), such as medication management or meal preparation. The growing number of people with dementia will also mean more people will require supervision due to their cognitive decline.

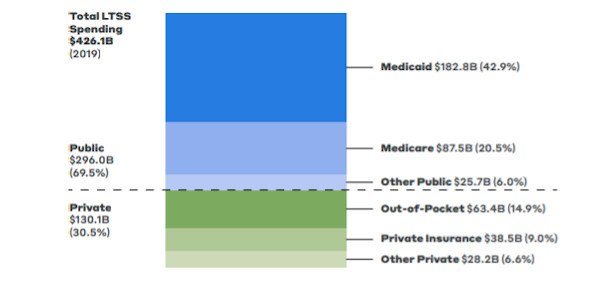

Health insurance, including Medicare and supplements, will only pay a very small amount of skilled care services, and most long-term health care is not covered at all. Medicaid will pay for long-term care services but only if a person has little or no income and assets. The Medicaid program covers 43% of total long-term health care costs in the calendar year 2019.

American Families Face Enormous Challenges

The challenges long-term care places on American families is hard to fathom as about 21.3% of American adults (53 million) were unpaid caregivers in 2020 - Unpaid Family Caregivers Now Total 53 Million People | LTC News.

Almost 80% of unpaid caregivers reported having out-of-pocket expenses in helping provide care for a loved one. This spending is about, on average, a quarter of the caregiver's income on caregiving activities. Of course, the job of a family caregiver is physically and emotionally demanding, creating a burden on the caregivers and their families.

According to National Health Expenditure Account data, the total amount of spending on long-term health care in the United States continues to grow, reaching $426.1 billion in 2019.

Long-Term Services and Supports Spending in Billions, by Payer, 2019

Note: This analysis of data also includes Medicare post-acute care spending in an expanded definition of long-term care spending.

Source: Congressional Research Service (CRS), August 2021.

Older Adult Demographics Growing

The population is getting older, and with about half of all Americans who reach the age of 65 needing long-term health care, the impact on families, finances, and the taxpayer will increase in the years to come.

Older adults will make up a more significant portion of the U.S. population through 2050. The Congressional Budget Office projects that long-term health care spending for those ages 65 and older will more than double from 1.3% of the gross domestic product in 2010 to 3% in 2050.

Keep in mind that a growing number of people under age 65 require long-term care services as advances in medical science allow people to survive health problems and accidents more than ever before. However, if an individual does not recover - but does not die - long-term health care will be required.

Partnership Long-Term Care Insurance

The report said the Long-Term Care Insurance Partnership Program, authorized by the federal Deficit Reduction Act of 2005, attempted to incentivize the purchase of qualified Long-Term Care Insurance by providing dollar-for-dollar asset protection - What is a Long-Term Care Partnership Policy? | LTC News.

There are also federal tax incentives and, in some states, state tax incentives in place. Recently, Washington State instituted a tax on income on any person aged 18 and over who did not own a Long-Term Care Insurance policy. Several states are now reviewing whether to follow Washington State's lead by instituting a punitive incentive for the purchase of private Long-Term Care Insurance.

Congress is considering several proposals to authorize some type of federal long-term care program, but most observers say there is little chance that any of these will become law anytime soon.

President Biden has proposed additional federal tax incentives for Long-Term Care Insurance, but no details have been released. There is also a proposal to allow penalty-free withdraws from IRAs to pay for Long-Term Care Insurance.

Some People Still Deny Risk of Needing Future Care

Many financial specialists recommend some planning for long-term health care. However, many people fail to consider Long-Term Care Insurance because they feel they will never need care or because they think the insurance is too expensive.

Recent Boston College research says that only one in five adults aged 65 and older will avoid needing any care, with an additional one in five requiring only a minimum amount of care - Only 1 in 5 Adults 65+ Will Avoid Needing LTC | LTC News.

While the perception is that Long-Term Care Insurance is expensive, most people purchase the insurance when they are younger (in their 50s) when premiums are much lower. Premiums can vary over 100% between insurance companies for similar benefits.

There are several types of policies available, so there are many choices for consumers. Specialists can review the many options that are available Work With a Specialist | LTC News.