Dementia Diagnosis – Now What?

Every day some American family has the crushing news that a loved one has been diagnosed with dementia. Many people get focused on other health issues, but as we get older, Alzheimer's and other types of dementia has a significant impact on families.

For example, women age 60 and older have a 1 in 6 chance of suffering from Alzheimer's disease in their lifetime. These women are twice as likely to develop Alzheimer's compared with breast cancer, according to the Alzheimer's Association.

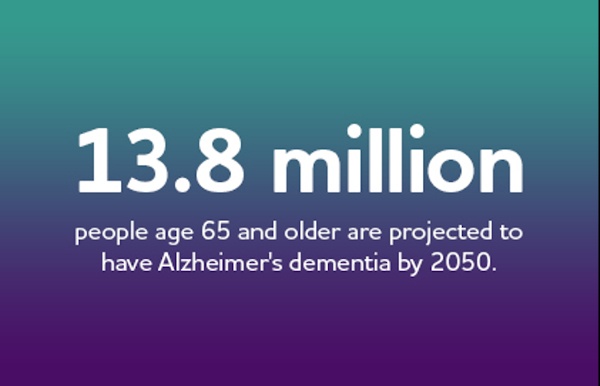

The numbers are staggering and continue to get bigger. Nearly 6 million Americans of all ages have Alzheimer's right now. The Alzheimer's Association tells us an estimated 5.8 million Americans aged 65 and older live with Alzheimer's dementia in 2020. Of those, 80% are age 75 or older.

Half of Those Age 80 and Over Have Dementia

Half of the people age 80 or older have some form of dementia. With Americans getting older and as the Late-Boomers and Generation X aging in mass and the remaining Baby-Boomers getting even older, the total number of people who will suffer from some form of dementia will continue to rise dramatically. By the year 2050, a projected 13.8 million Americans will suffer from a cognitive decline.

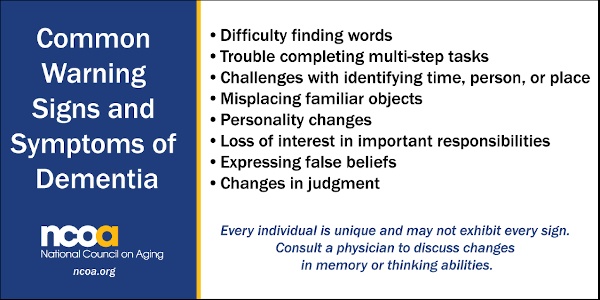

When a loved one, or perhaps yourself, starts to suffer from a cognitive decline and you get the initial diagnosis of dementia, what is next? First, the family should note the exact symptoms the person is experiencing. Be sure to get all of them as this will be important clues for the medical professionals.

It Might Not Be Dementia - Drug Side Effects Can Cause Memory Issues

Experts suggest first being sure to rule out other reasons for the problems with memory. A medication could be causing the issues with memory. Carol Bradley Bursack, a veteran caregiver and columnist, says that investigating drugs and the side effects are the first thing the family and doctor should review.

"Many frequently prescribed drugs are anticholinergic, which in lay terms means detrimental to brain function, especially for older adults. The accumulation of these drugs can cause dementialike symptoms," she said.

She adds that vitamin deficiencies will sometimes cause memory problems. The common culprit is Vitamin B12, as it's often poorly absorbed in older people's bodies.

Common infections can be another source of the memory problem.

"There is a need to look for any type of infection such as one of the urinary tract that can have a profound effect on older people," she writes.

What To Expect from Doctors

Dementia can often be very mild at first. Over time it can become more severe, requiring the individual to need constant care and supervision. Once you rule out some other cause of the cognitive decline, which might be treated, what actions should be taken?

It will start with medical exams and testing. A doctor will complete a family history. They will do a complete physical evaluation, which usually includes lab work and imaging.

The doctors need to rule out medical conditions that could be causing the symptoms. Doctors will review your medications and supplements. Ensure the doctor knows of all over-the-counter medications, supplements, and vitamins the person is taking.

The doctors may do additional memory screening. The cognitive assessment will help them determine the severity of the memory loss. The testing can include word recall, word association, and even simple math. The doctor may ask the individual to draw items like a clock.

The doctor may suggest the person see a geriatrician or geriatric nurse practitioner, neurologist, geriatric psychiatrist, or neuropsychologist for additional review. Once completed, the doctor will review the results of the testing.

Consider Counseling for the Family

Many experts suggest counseling for both the person who has dementia and their families. Many clinics have available programs which many people find very helpful. Remember, the family members also face stress and anxiety when they have a spouse or parent who is suffering from dementia. The family needs support just as much as the person who is suffering.

If the person with the dementia diagnosis still has some level of cognition, they should start making plans assuming they have not already been completed. Items like a will or medical and financial power-of-attorney are essential tools to help the family make sure their preferences are known.

Review Finances and Develop a Plan

A review of insurance and assets should be done right away. Does the individual own Long-Term Care Insurance? If so, find the policy and review the benefits with the agent or financial advisor. If no LTC policy is available, it is already too late to obtain coverage since they are medically underwritten, a dementia diagnosis would make the individual uninsurable.

If they own life insurance see if the policy has a disability or chronic illness rider. Some people own a final expense insurance policy that will pay for funeral expenses. While it is a difficult conversation, be sure the family is aware of their final wishes when it comes to a funeral.

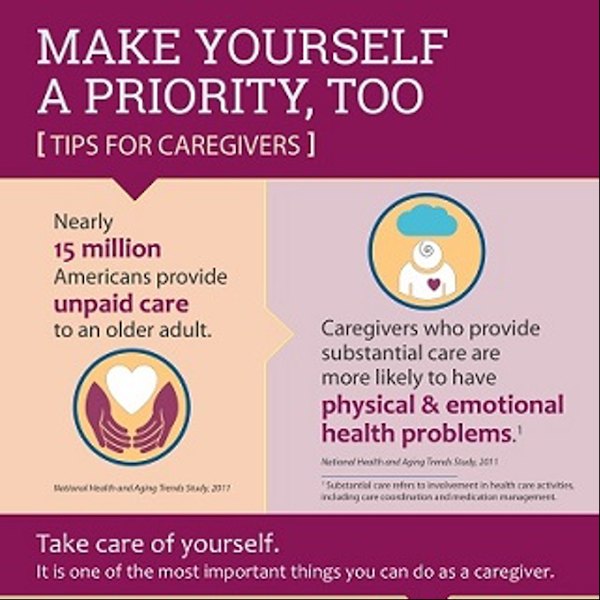

A plan of care will be developed. Depending on cash flow and available assets, paid care can be brought in, or the family will have to create a plan where family members become caregivers. A plan with family members as caregivers is not ideal and poses tremendous burdens and health problems for the caregivers. Sometimes a combination of paid care services and family members will make it easier for family and easier on the pocketbook.

Cost of Long-Term Care is Expensive

Paid care is expensive. When there is no advance plan, the result is usually a family crisis. If there is no plan the family should get together and review all the options, including the amount of financial resources available to pay for long-term care.

The LTC NEWS Cost of Care Calculator is an outstanding tool to get an idea of the cost. The calculator will show you the current and future cost of extended care services where you live.

If the individual has Long-Term Care Insurance, do not hesitate to start the claim. Experts suggest not delaying using the tax-free benefits from a policy. Sometimes families think they should wait for when it gets worse. There is never a guarantee of how long a person may live. If the person needs care and supervision, make a claim.

Family Caregivers Will Experience Stress and Anxiety

If no Long-Term Care Insurance exists, the family will be responsible for managing paid care services or providing care. Family caregivers often have anxiety and other health issues to deal with as they find themselves in the role of caring for a loved one.

There are several resources to help family caregivers. Read more from the National Institute on Aging.

Prepare Family and Finances Before Retirement

The ideal way to address the financial costs and burdens of aging is to plan before any memory loss or other health issues occur. Long-Term Care Insurance can offer you tax-free benefits to safeguard savings and income and ease the stress otherwise placed on loved ones. However, policies are medically underwritten, so you must enjoy fairly good health.

Experts suggest starting your research in your 40s or 50s. Premiums are much lower at younger ages, but perhaps, more importantly, your health is better as well.

Find a qualified Long-Term Care Insurance specialist to help you navigate the many types of plans and policy designs available. Don’t rely on a general insurance agent or financial advisor as most don’t have the knowledge required or the availability of multiple products and insurance companies.

Your health, body, and mind will change in the decades ahead. Be prepared and avoid the family crisis that otherwise burdens loved ones.