Medicaid is Never the Goal or Solution for Long-Term Care Planning

For many families, long-term care has long been a looming concern. The COVID-19 pandemic only intensified this issue, bringing it to the forefront of national conversation. However, the most powerful motivator for planning is often personal. We've all likely witnessed a loved one struggle with the challenges of aging or sudden health changes.

Without a plan in place, the burden often falls on family members who become caregivers, either full-time or part-time. This role can be incredibly demanding, both physically and emotionally. Relying solely on paid care services can also be a financial strain, potentially depleting retirement savings and impacting one's standard of living.

The reality is that traditional health insurance and Medicare typically don't cover long-term care needs, except for short-term skilled care. Without long-term care insurance, the costs often come directly from your savings or are shouldered by unpaid family caregivers.

Medicaid: Not Your Default Long-Term Care Solution

While some online content might portray Medicaid as the answer for everyone, it shouldn't be your default plan if you have savings. The claim that Medicaid is "Long-Term Care Insurance for the middle class" is misleading. In 2005, legislation aimed to help middle and upper-middle-class individuals manage long-term care costs, but it wasn't designed to be a universal solution that wipes out your savings.

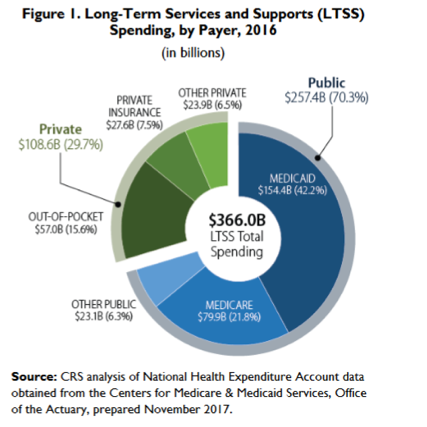

Medicaid is indeed the primary payer for long-term care in the U.S., but it was originally established as a public health insurance program for low-income individuals, not as a one-size-fits-all solution for everyone.

The Deficit Reduction Act of 2005 further tightened asset transfer rules to prevent people from using Medicaid for long-term care while keeping their assets. This act established a 60-month look-back period for asset transfers (including most trusts). You may face penalties if you transfer assets within this timeframe and then need Medicaid to cover care costs. The penalty period starts when your assets fall below a certain threshold (currently around $4,150), and you apply for Medicaid assistance.

This emphasis on asset transfers highlights a key point: Medicaid wasn't designed to be your primary long-term care strategy. In addition, you lose choice when you qualify for Medicaid as you are required to use Medicaid providers. Most people are concerned with the quality of care, which some people say often lacks with Medicaid due to their low reimbursement rate for providers.

A proactive approach can help you secure the care you need without jeopardizing your financial security.

The Kaiser Family Foundation reports six in ten nursing home residents are on Medicaid. One in three people, age 65+, will spend time in a nursing home, not to mention long-term care services people need in their own home, adult day care centers, assisted living, and memory care.

Generally, Medicaid will only pay for care in a nursing home, but in some states, they are testing community care programs to give other options for those who require care and have little or no resources.

Medicare and Health Insurance Are Not Long-Term Care Solutions

Medicare is a health insurance program for people aged 65 and older. It is not a long-term care solution. Medicare will only pay for a limited amount of skilled services, such as skilled nursing care and rehab. Medicare will pay for up to 100 days of skilled nursing care per diagnosis, but you must use a Medicare-approved skilled nursing facility within 30 days of a hospital stay that lasted at least three days. Plus, the care you receive must be for the exact same condition you were being treated for in the hospital.

For example, if you have a stroke and are hospitalized for six days, you may require rehabilitation in a skilled nursing facility. Medicare (including benefits from a supplement) will pay up to 100 days in total for this care. If you require care for a longer period of time, you will pay for that care out-of-pocket unless you have Long-Term Care Insurance.

Medicare also has large deductibles after day 20. Most people will have a supplement to Medicare that will pay those deductibles. However, Medicare supplements follow the Medicare rules and will not pay beyond the 100-day limit and only for skilled services.

Most Long-Term Care Is Custodial

Most long-term care is custodial, meaning help with activities of daily living (ADLs) or supervision due to a cognitive impairment. Health insurance and Medicare will not pay for custodial care. Long-Term Care Insurance will pay for this care, and Medicaid will also pay for custodial care if you qualify.

ADLs include tasks such as bathing, dressing, eating, toileting, transferring (getting in and out of bed or a chair), and continence. Cognitive impairment refers to a decline in mental abilities, such as memory, thinking, and judgment.

Medicaid Rules

While Medicaid will pay for long-term care services, you need to have little or no assets to qualify. Generally, a person can have no more than $2,000 in assets; however, some states allow more. Some assets are excluded by law. Find your state on the LTC NEWS Cost of Care Calculator and see general information on not only the average cost of long-term care services and supports but the Medicaid requirements.

You can read the Medicaid rules by clicking here.

Hiding or Giving Away Assets? Not a Long-Term Care Solution

Some lawyers suggest hiding or giving away assets to qualify for Medicaid. However, most of these schemes are questionable at best. The Deficit Reduction Act of 2015 (DRA) placed more restrictions on these practices in an attempt to preserve the Medicaid program for the "true" poor, not for clever people to find a way to get the taxpayer to pay for their long-term care.

The DRA made noteworthy changes to Medicaid's long-term care rules, including:

- The look-back period: This is the five-year period during which the government will look back to see if any assets have been transferred in order to qualify for Medicaid.

- The penalty start date for transfers: If assets are transferred within the look-back period, the penalty period will begin on the date of the transfer.

- The undue hardship exception: This exception allows people to transfer assets without penalty if they can prove that they would suffer an undue hardship if they did not transfer the assets.

- The treatment of annuities: Annuities are now considered to be countable assets for Medicaid purposes.

- Community spouse income rules: These rules ensure that the community spouse of a Medicaid beneficiary is not left with too little income after paying for the beneficiary's long-term care expenses.

- Home equity limits: The home equity limit for Medicaid purposes was increased in the DRA.

- The treatment of investments in continuing care retirement communities (CCRCs): CCRC investments are now considered to be countable assets for Medicaid purposes.

- Promissory notes: Promissory notes are now considered to be countable assets for Medicaid purposes.

- Life estates: Life estates are now considered to be countable assets for Medicaid purposes.

- Long-Term Care Insurance Partnership programs: These programs allow people to purchase private Long-Term Care Insurance and then protect some of their assets from being counted against them when they apply for Medicaid.

It is important to note that these are just a few of the changes that the DRA made to Medicaid's long-term care rules. If you are considering applying for Medicaid, it is important to speak with an attorney to understand the latest rules and regulations.

Transfer Rules Under DRA Regulations

The Deficit Reduction Act (DRA) established a 60-month (or five-year) look-back period for asset transfers. While the IRS allows annual gifts of up to $15,000 per recipient without incurring a gift tax, utilizing such gifts to qualify for Medicaid under the DRA can be challenging. Transferring assets during this five-year period to achieve Medicaid eligibility can trigger penalties.

It's worth noting that while some high-quality facilities do accept Medicaid, the overall care quality at predominantly Medicaid-funded facilities can sometimes be compromised due to the program's lower reimbursement rates. Whenever possible, seeking alternatives to Medicaid for long-term care can lead to a higher standard of care.

For middle and upper-middle-class families looking ahead to retirement, the DRA introduced a promising tool: the Long-Term Care Partnership Program. This program, initially limited to four states, was expanded by the DRA to include additional states, providing more Americans with a valuable option for future care planning.

LTC Partnership Program Does Provide Dollar-for-Dollar Asset Protection

Forty-five states now have active partnership programs in place. Find your state by clicking here. The Long-Term Care Partnership Program may be one of the biggest secrets in retirement planning.

Under a qualified partnership-certified Long-Term Care Insurance policy, purchasers can access what's commonly termed "dollar-for-dollar asset protection" or, in bureaucratic parlance, "asset-disregard." This essentially means that if a policyholder depletes their policy benefits, they can legally protect a portion of their assets equal to the insurance policy's payouts and still be eligible for Medicaid.

Simply put, this arrangement allows individuals to access government assistance without depleting all their assets. Furthermore, if you've been paying their standard rates for a certain period, some care facilities may permit you to remain in their care and accept Medicaid payment once your insurance benefits are exhausted.

Prioritizing choice remains a compelling argument against strategies that involve manipulating assets to qualify for Medicaid. A Long-Term Care policy affords policyholders the flexibility to select the type of care they want, be it at home, in adult daycare, assisted living, memory care, or a nursing home. These policies typically cover both skilled and custodial care, spanning a variety of settings, empowering individuals with greater control and autonomy over their care decisions.

There's a common misconception that Long-Term Care Insurance comes with a hefty price tag. However, this isn't necessarily the case. These policies are tailored to individual needs. Policyholders can determine the scope of their coverage, and for those residing in partnership states, there's added versatility in designing a plan that's both cost-effective and aligns with their savings protection goals.

Fact: Long-Term Care Insurance is Affordable

Premiums are based on several factors, including your age, health, and family history. Plus, Long-Term Care Insurance is custom-designed. You select the total amount of benefits you wish to have in place. The more benefits you wish to have, the larger the premium.

Generally, you select a monthly or daily benefit. This is the maximum amount of benefits you have available daily or monthly. Next, you select an initial "pool of money," which is how much your policy is worth at the time of inception.

You can also select an inflation benefit that increases your benefits every year. You also will have an elimination period. The elimination period is a deductible based on "days," not "dollars."

For many, securing suitable coverage can cost under $150 monthly, with rates potentially dropping for those younger and in prime health. Couples often benefit from available discounts, and shared benefits are an option for spouses or partners. Some policies even come with death benefits.

For those with substantial assets, a heftier policy might be more fitting.

Options to choose policies with unlimited benefits are also on the table. Regardless of the policy's scale, many offer value-added features, including professional case management for most. Such provisions assist policyholders and their families devise care plans and coordinate care services, significantly easing the potential strain on loved ones. See for yourself the actual cost of LTC Insurance by reviewing our survey of premiums from all the top-raated isnurance companies offering these policies - How Much Does Long-Term Care Insurance Cost?

Many States Have Rate Stability Rules in Place

Many states have rate stability rules that make it very difficult to increase premiums on today's Long-Term Care Insurance. See if your state has this consumer protection by clicking here.

Asset-based policies that combine life insurance or annuities with a rider for long-term care can be purchased with one single premium or ongoing premiums. These policies are called "hybrid" policies in that they combine the benefits of a life insurance or annuity policy with that of a Long-Term Care policy. They also give you the extra security of a death benefit.

Your choice of quality care, asset protection, and peace-of-mind comes with a Long-Term Care policy but does not come from a scheme that places you directly into the Medicaid program. Experts suggest planning prior to your retirement, in your 40s or 50s, for the most options at the lowest premiums.

Start Your Research with LTC NEWS Tools

It would be best if you started your research by finding the current and future cost of long-term care services where you live. The LTC NEWS cost of care calculator is an outstanding tool. Access this tool by clicking here.

Your financial advisor or general insurance agents are usually not qualified to help you find appropriate coverage. The American Association for Long-Term Care Insurance, a national consumer advocacy and education group, recommends seeking the help of an experienced Long-Term Care Insurance specialist who works with multiple top insurance companies.

Be sure they understand underwriting rules, policy design, partnership, hybrid options, and claims. You can find a qualified Long-Term Care specialist to help you design and shop for the best coverage at the best value by clicking here.

Know the facts and understand the real risks of longevity on you, your family, savings, and lifestyle.

Share your thoughts and experiences about aging, caregiving, health, and long-term care with LTC News —Contact Us at LTC News.