Will Medicaid Cuts Impact Long-Term Care

Debate about repeal and replacement of Obamacare - Affordable Care Act – has brought attention to an issue many people like to forget about. That issue is Long-Term Care. Now pundits and politicians are talking about long-term care and how the “drastic cuts” in Medicaid will impact our senior citizens today or you down the road. This is a big issue since the US Department of Health and Human Services says if you reach the age of 65 you will have a 70% chance of needing some type of long-term care service before you die. Not all of those people will end up in a nursing home and some will need extended care for six or seven months. However, the attention aging and the financial costs and burdens of aging has opened the eyes of many people as the population continues to age.

Medicaid is the primary payer for institutional and community-based long-term services and supports. The most recent CMS Actuarial Reports says almost 25% of Medicaid’s budget went to providing long-term care services. That represents about 40% of all long-term care expenses in the US. Medicaid, the nation’s main public health insurance program for people with low income, is administered by states within broad federal rules and financed jointly by states and the federal government. Cuts in Medicaid could then impact those requiring long-term care services. However, Medicaid was never intended to be the primary payer of long-term care services and it sure would not be the goal for anyone with savings since it would require a “spend-down” of assets.

To qualify for Medicaid most states require the person to have no more than $2000 in savings. Some states give you a little more some a little less. In addition, a living spouse is allowed some assets and they will not be kicked out of their home although estate recovery may end up eating most if not all the value in your real estate at the end. You can see the spend-down requirements of your state here.

So, will the deep cuts impact you or your family? Some politicians say people will die. Daniel J. Mitchell is a senior fellow at the Cato Institute who specializes in fiscal policy. He says that some critics imply that “deep cuts” will hurt the quality of care and perhaps will die because of them but the cuts in Medicaid are not really cuts at all.

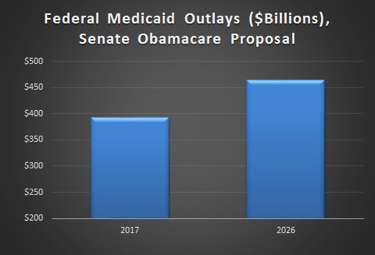

“There’s one small problem with the argument, however. Nobody is proposing to cut Medicaid. Republicans are merely proposing to limit annual spending increases. Yet this counts as a “cut” in the upside-down world of Washington budgeting, “ Mitchell wrote in an article posted recently https://fee.org/articles/the-great-medicaid-myth-there-are-no-cuts/?utm_source=sumome&utm_medium=facebook&utm_campaign=sumome_share

Many suggest the need to come up with a way to promote private long-term care insurance. Conservatives advocate greater use of private-market insurance solutions, while liberals advocate for stronger public social insurance. However, Washington has made it clear, since 1996, that the federal government can’t be the primary payer of long-term care services.

In 1996 President Clinton signed the original HIPAA act which provides tax advantages and other benefits for private long-term care insurance. In 2005 President Bush signed the Deficit Reduction Act. This closed many loopholes which allowed people with resources to hide or give-away money and still qualify for Medicaid. In addition, is expanded the Long-Term Care Partnership Program and made it available to the states. Today most states have active programs. This provides a consumer the ability to purchases a partnership certified Long-Term Care policy and get additional dollar-for-dollar asset protection.

Many experts say few people are aware of the partnership program. Others suggest long-term care insurance is too expensive.

“The biggest miss-conception concerned consumers have is affordability. Long-Term care insurance is affordable if one understands the continuum of chronic care,” said George Mellendorf, a Florida based expert in Long-Term Care Insurance. Mellendorf says 82% of one of the leading carriers Long-Term Care insurance claims are paid for care outside of a skilled nursing home. This choice of care outside of a facility also places less pressure on the system.

“People with even a modest amount of LTC insurance are able to stay home longer and more effectively when the "informal" caregivers - spouse, partner, adult children - can take a break. And while Alzheimer's and other forms of dementia that have longer than average care horizons are scary, even a three or four-year benefit period can provide substantial value, especially in keeping the person who needs care home longer,” said Bill Comfort, owner Comfort Long-Term Care, a LTC specialty agency with offices in St. Louis, MO, and Durham, NC.

To some experts the best solution may be a compromise hybrid of both approaches. The reports were developed by a nonpartisan consortium of researchers, representing an ideological middle ground. They call for streamlining and simplifying private long-term care insurance to make it work better, but also covering the most extreme risk through a publicly financed insurance program.

“The people I speak with understand the government has too many other budget concerns than to provide everyone with long-term care services and they sure don’t want to spend all their hard-earned assets in the process,” said Matt McCann, a national expert in Long-Term Care planning.

“Even a small partnership policy provides outstanding asset protection. Most people are very surprised how affordable a Long-Term Care policy actually is. They read some scary stuff but the truth is for most people who are adding Long-Term Care Insurance to their future retirement plan the premiums are very affordable,” he added.

With the sudden attention will people go out and plan? Federal tax incentives are available for some people and some states offer state tax incentives as well. Pre-tax money from Health Savings Accounts can also be used to pay for premiums. The big question is will the Trump Administration, which has talked about an above-the-line tax deduction for health insurance and long-term care premiums get their way with an even bigger tax incentive?

“A tax deduction would help. I think it's even good policy because it will dramatically offset government expenses down the road. Partnership LTC insurance has proved this, which is why it was expanded in 2006 and jumped from four states to 44. But just because there's a deduction, doesn't mean millions will rush to buy, we will still need strong financial advisors advocating for this critical but not mandatory protection, Comfort explained.

No matter what happens the facts seem to suggest nobody is immune from the impact of aging. Former US Surgeon General Vice Admiral Vivek H. Murthy, M.D., M.B.A. said aging is a very important public issue.

“All of us are aging no matter what age we are at, to be clear,” said Murthy while speaking at the 2015 White House Conference on Aging.

The former Surgeon General said he has had a conversation with his parents about aging and their future needs.

“The conversations we have had is how they can stay healthy and independent as they get older recognizing they want to be part of their children’s lives but they don’t want to be dependent on their kids for everything,” he said.

What have you done to plan for the costs and burdens that come with getting older? Unless there is a plan in place the government plan will adversely impact your savings and care choices.